Could green ink flowing through human veins overcome a robot invasion? Not in a black-and-white arena. But our world is grey and demands judgement. That, and the embarrassing fact that accountants are only human after all, will ensure the profession’s survival.

I take pride in my most robot-like qualities: my attention to detail, my willingness to work through the night to reach a deadline, and, above all, my Excel skills. After all, these are some of the virtues that earned me the right to put C.A. behind my name.

Why then do accountants, me included, fear digital transformation? Because no amount of green ink or work ethic could compete with a well-taught robot. And after centuries of proclaiming our super-human analytical abilities, it is downright scary for accountants to confront machines that perform precisely, absolutely and without fail.

| Let me break professional confidence: we accountants secretly relish being the butts of jokes that stereotype our alleged soulless dedication to process over personality. We love it because those jokes confirm that we live up to the ideal we have created for ourselves. They describe our perfect world, where rules are applied objectively and without emotion. Indeed, we have set ourselves up to be replaced by robots because they are, well, even better at being machines.

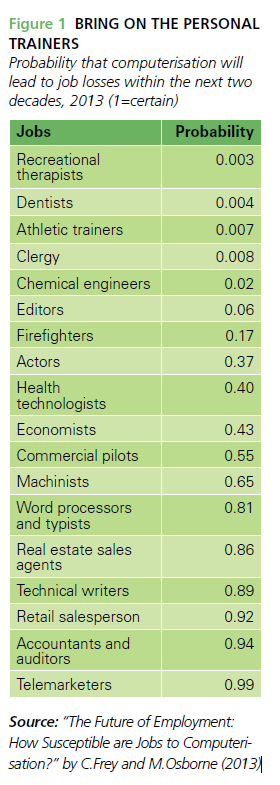

Little wonder then that I spent sleepless nights over a study that found that accountants and auditors run the second-highest risk of being replaced by robots. (My heart bleeds for you, telemarketers!) But fear not, for when futurists forecast that robots will replace accountants, it is not a prophecy of a “robot invasion”. It is in fact a reference to “robotic process automation”, or RPA for short. That is, technically defined, “the application of technology, governed by business logic and structured inputs, aimed at automating business processes”. Or, in human speak, making machines do the donkey’s work. So how should our profession ensure its relevancy? You have two chances. First, be the one to teach the robot The phrase “see one, do one, teach one” is often used for medical personnel, reflecting a teaching method in which a surgical student will observe a procedure, perform the surgery on their own, and then teach another trainee where to cut and stitch. |

|

To understand and appreciate the robot you are due to teach, you must embrace the digital journey and invest in building digital acumen. Accountants need to understand emerging technology. Just like the best primary school teachers are kids at heart, software designers need to get under the robot’s digital skin. (Who could be better at that than accountants who are, at least according to the professional jokes, barely an emoticon more charismatic than a robot?)

Before you can deploy your newly taught robot in the finance departments of the real world, a flesh-and-blood accountant needs to evaluate the results presented by the robot to ensure its accuracy and completeness. This evaluation requires an accountant that understands structured and unstructured data. This sought-after accountant of the future will possess a fine balance of traditional accounting skills and the ability to solve problems through logical reasoning and critical thinking, reaching much further than applying a regulatory framework like IFRS or GAAP. The need for good old common sense creates vast opportunities for experienced and skilled professionals, specifically those with a healthy appetite for data synthesis and analysis.

These opportunities also exist within SYSPRO. We will be taking ownership of our product’s digital journey to persuade less adventurous accountants to accept the robots.

Now, embrace your inner human

RPA is already doing heavy lifting in routine, repetitive and rules-based tasks – the donkey’s work. And they are dream colleagues. No untimely family responsibility leave. No untoward office romances. No overtime demands. It is a walk in the park for the team in human resources, while the budget controllers love that robots come at one-ninth of the cost of a full-time employee in the U.K.

But what happens after the repetitive tasks have been completed and the rules depleted, but the exceptions tray is full? Someone with integrity and professional scepticism must evaluate those exceptions. The bulk of existing RPA functionality relies on business rules engines. Those rules only work in distinctly black-and-white scenarios. In the real world, accountants deal with grey areas, and that is where they will apply their professional scepticism and their strictly human sixth sense to support the robot.

Then some human with real insight needs to look beyond the numbers and collaborate with people inside and outside the business to interpret and apply them to help the organization achieve its strategic objectives. This surfaces new opportunities within business consulting and advisory roles for accountants.

And ultimately, when humans have sorted out the exceptions and interpreted the numbers, someone must sit at a boardroom table and communicate the results in a way that is, well, human.

Accountants will only remain relevant if they develop and balance their technical and interpersonal skills. For too long have we laughed along at accountant jokes that falsely stereotype us as lone wolves who prefer the buzz of calculators over human communication.

The robots have taken over the cubicles. Now is the time to speak and be human as if your livelihood depends on it. Because it does.