One of the world’s largest container ships recently made headlines after it became wedged across the Suez canal and blocked normal cargo flows. The daily losses due to the supply chain disruption was estimated at between $12 million to $15 million. This example is just the tip of the iceberg for many manufacturers and distributors, as disruptions, operational efficiencies and disparate systems became the reality over the past year due to the pandemic.

Even a number of so-called “black swan events” – the Japanese earthquake and tsunami, the flooding in Indonesia and even the Filipino volcano eruption– seemed to show the ability of supply chains to keep going. But the disruption caused by the Coronavirus highlighted risks and vulnerabilities in supply chains in an unprecedented way.

As a result, businesses have come to realize that in order to overcome supply chain disruptions, their business operations need to consider a different approach to ensure supply-chain resiliency. One option could be to consider SEA as a central component in the global supply chain.

Seizing the SEA opportunity

In recent decades, ASEAN manufacturing, once seen as a global phenomenon, has been overshadowed by the meteoric rise of Chinese factories. Traditionally, supply chains were heavily integrated and reliant on foreign raw materials, in particular from China. With global lockdowns resulting in the increasing shortage of parts, manufacturers and distributors have had no choice but to find alternative solutions. We are starting to essentially see shift away from China.

The shift is creating a huge opportunity for SEA to grow significant market share if they adopt the right technology strategy. In fact, what we are seeing is that South East Asian countries such as Malaysia, Indonesia, Philippines and Vietnam, now have the potential to become central components in the global supply chain.

The major benefit in most ASEAN countries has been labor costs, in many cases much less than China’s costs. However, to be attractive to multinational manufacturers and bolster its manufacturing economies, the region cannot compete on low wages alone. It must also focus on improving productivity, which, along with making the region more attractive to foreign investment in manufacturing, can also support domestic improvements in wages and living standards. Vietnam, for instance, seen by some as a close rival to China, is 87 percent less productive than China with respect to daily output per daily wage according to the Mckinsey Industry 4.0: Reinvigorating ASEAN manufacturing for the future report

Closing the productivity gap with the right technology investment

Research shows that the digital economy in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam reached US$100 billion in 2020. By increasing operational efficiencies and shortening time to value, Industry 4.0 can assist ASEAN manufacturers to overcome relatively low productivity rates to regain their stature as factories to the world. The challenge is that most ASEAN countries have been traditionally slow to adopt Industry 4.0 technologies. But this is about to change.

With the region adding 40 million new Internet users last year alone, the digital economy in SEA is projected to triple by 2025. As a result, ASEAN member states have the opportunity to exploit Industry 4.0 technologies to stake their claim to be the factory of the world. SEA governments are also awakening to this and are already implementing strategies to advance the rollout of Industry 4.0. In fact, on the ground, strong demand and equally striking investment potential are giving credence and support to these bold policies and visions. This year, the members of the Association of Southeast Asian Nations (ASEAN) aim to complete a Consolidated Strategy on the Fourth Industrial Revolution (4IR).

The foundational elements needed to bring manufacturers and distributors fully into the Industry 4.0 era

A newly imagined supply chain will demand a secure digital future. Manufacturers and distributors will need better clarity and transparency of information across the business to enable enhanced decision-making in real-time. This will build the foundations for other strategic technologies down the lines and bring manufacturers and distributors fully into the Industry 4.0 era.

There are some key supply chains processes to consider.

Scheduling

Many businesses do not see scheduling as a critical business process and consequently do not identify talent to run this section. Poor scheduling struggles with several issues:

- Multiple processing stages and complex production routes

- External parameters and constraints in supply chain or logistics

- The need to regularly evaluate executed schedules in terms of efficiency

- Machines with variable capabilities

With complex supply chains feeding complex high-speed machinery, and multiple routings through the factory due to flexible machinery, a scheduler needs to manage a much greater number of options. This cannot be planned manually.

Automated Planning and Scheduling (APS) systems can optimize the multiple dimensions, routes and constraints to deliver the best outcome for customer service.

Forecasting

Forecasting is another problem area for many manufacturers – often at best only 60% accurate. As with scheduling, planners doing it manually struggle to create forecasts with spreadsheets that weren’t designed to collect or manage all the information and input needed. With an APS system, planners have access to a supply chain planning solution that offers information inputs from various sources. They can segment demand forecasts as well as analyze demand down to the SKU level.

Automation

Automating the interface between machines and data collection is another driving force to improve management and monitoring of manufacturing. Initiatives such as automation can have an impact on a manufacturer’s overall supply chain operations. Automation keeps track of production flow and data and can link to order and sales information to see how customers’ requirements are changing. Automation allows manufacturers to more easily adjust to the variable supply chain demands.

How ERP can help manufacturers

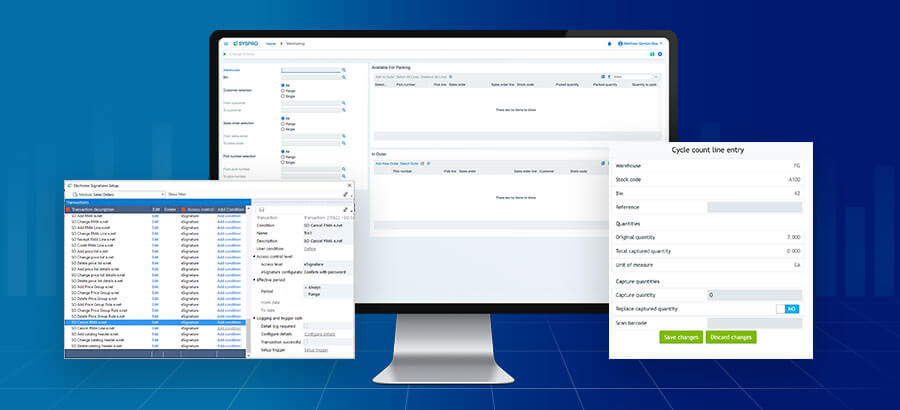

Modern ERP systems provide visibility across the full organization value chain. Coupled with an Manufacturing Execution System (MES), ERP offers full visibility across production planning and scheduling, manufacturing, dispatch and inventory control.

An ERP application which includes supply chain management (SCM) capability creates more efficient processes and workflows that control the data required to manage suppliers and customers. It can improve procurement, fulfilment, and orders, as well as inventory, warehouse, and shipping management. A properly implemented SCM can reduce inventory without compromising service levels or impede production.

By outsourcing much of the software and data storage with cloud ERP, manufacturers can not only reduce IT and related expenses, but it can also make it easier to bring new operations online from anywhere in the world. With the visibility it also brings, manufacturers can better plan and anticipate inventory levels.

Changing supply chains the next normal

The COVID-19 pandemic has accelerated changes that were already happening; it may be the tipping point for the factory of the future. Forward-thinking manufacturers are reviewing their supply chain strategy.

Manufacturers within SEA now have a tangible opportunity in front of them, and the time to invest and thrive into the future by Industry 4.0 is now.

Rob recently presented his insights around the SEA opportunity in a recent Panorama Consulting webinar.